Read on Substack

Read time - Less than 5 minutes

Is building wealth confusing for you?

Don’t worry, I’ve been there.

I went through trying:

MLM

Online sales

Forex trading

Crypto trading

Only to finally land on these 5 secrets which I will share in today’s newsletter.

The internet is filled with multiple pieces of advice, especially when “financial influencers” share tips and tricks that may or may not be helpful for you.

Or worse, when it is filled with agendas for a bank or an insurance sales company.

After going through multiple mistakes, I came up with these 5 ways:

1) Master Your Money

Use the 60/20/20 Rule: This rule is a powerful starting point, but it's not set in stone.

You should adjust it based on your situation and goals.

Expenses & Wants (60%): Track your spending and identify areas where you can cut back. This includes necessities like rent/mortgage, utilities, groceries, and discretionary spending like entertainment and dining out.

Savings (20%): Building an emergency fund is crucial. Aim to save 3-6 months' worth of living expenses. Also, set up automatic monthly transfers to your savings account, even if it's a small amount.

Investments & Education (20%): This includes both investing in your future, like an investment account and investing in your personal growth through education and skill development.

2) Diversify Your Cash

Leaving your money idle in a bank account isn't enough.

Inflation eats away at its value over time.

Consider:

High-yield savings accounts: These savings accounts offer higher interest rates than traditional ones.

Long-term investments: Explore options like money market or index funds with low cost and consistent returns.

Investing in tangible assets: Real estate, precious metals, or art can diversify your portfolio and offer inflation-hedging capabilities.

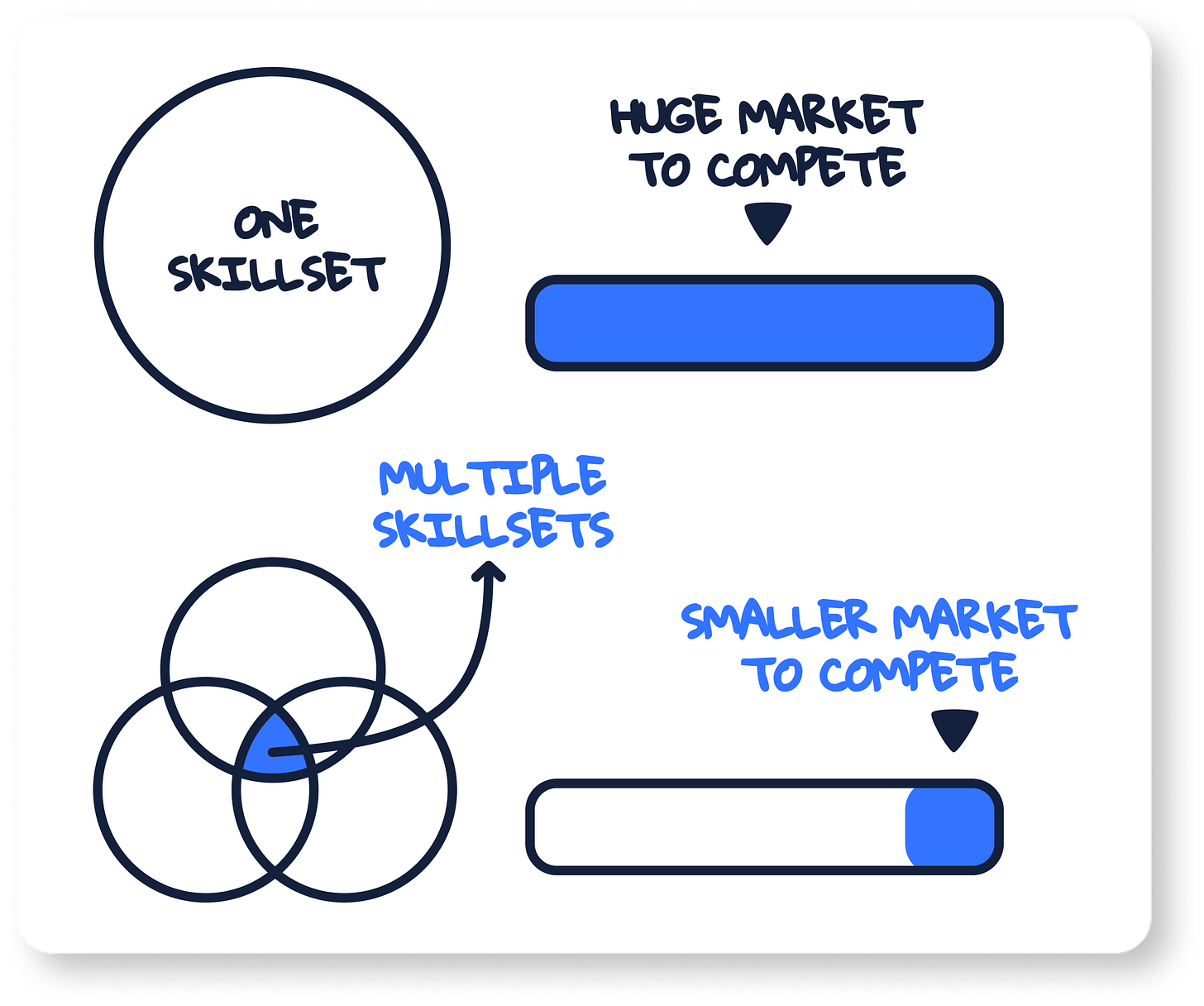

3) Invest in Yourself

Don't stop learning just because you have a degree.

Expand your skills: This could mean taking online courses, attending workshops, or reading books in your field.

Develop valuable skills: Soft skills like communication, problem-solving, and emotional intelligence are highly sought-after and can benefit you in any career.

4) Build a Side Hustle

Side hustles can be incredibly diverse and can generate income passively or actively.

Utilise your expertise: Offer your skills as a consultant, freelance writer, graphic designer, or virtual assistant.

Explore passive income: Create online courses, write an ebook, or invest in dividend-paying stocks.

A side hustle provides a buffer during tough economic times. Having an additional income stream can help you weather financial storms.

5) Cultivate Financial Wisdom

Understanding how emotions affect financial decisions is crucial.

Read books: Explore titles like "The Psychology of Money" by Morgan Housel, "Rich Dad Poor Dad" by Robert Kiyosaki, or “Just Keep Buying” by Nick Maggiulli.

Develop a strong financial mindset: Learn to overcome biases like fear of missing out (FOMO) and overconfidence, and develop a disciplined approach to money management.

Conclusion

Remember, building robust finance is a journey, not a destination.

Start with small steps, learn, adapt, and build consistent habits.

These 5 steps will empower you to make informed financial decisions:

Master Your Money

Diversify Your Cash

Invest in Yourself

Build a Side Hustle

Cultivate Financial Wisdom

Ready to start building your fortune?

The Financial Toolbox is your comprehensive guide to establishing your personal financial economy.

This course teaches you from the basics, equipping you with the knowledge to avoid making financial mistakes.

Here's what you can expect:

Practical money management

Tools to identify scams

Ideas to grow your savings

Setup investment accounts

Launch your side hustle

See you next week.

Whenever you're ready, there are 3 ways to kickstart your adult life:

1. The Modern Thinking Toolbox (Only $1): Join 30+ students in mastering psychological skills and revive your authenticity. This concise curriculum will teach you to resist conformity and live life true to yourself.

2. The Job Hunting Toolbox: Build your dream career by using unconventional methods. Over 10+ unique case studies, interview strategies and effective résumé templates to get your dream job without dreading Mondays.

3. The Financial Toolbox: Establish your personal financial economy. Grow your savings without sacrificing what you love, set up investment accounts in less than 3 days and manage your finances automatically & hassle-free.